Retirement, for many people, is a way to permanently escape the fast-paced, stressful existence of full-time employment. It is practically a vacation that never ends, so it’s only fitting to choose your location wisely.

Southeast Asia remains one of the top destinations for retirement globally. Low cost of living, beautiful beaches, warm weather, and affordable healthcare are just a few reasons why retirees continue to flock here when it comes time to quit the rat race.

Wondering how to retire in the Philippines? Look no further! Here’s how to tell if the Philippines could be the place for you to retire overseas.

The Philippines retirement visa just might be the best out there. The country makes an effort to attract ex-pat retirees, offering an easy, perk-filled path to permanent residency. The standard of living in the Philippines is high and the opportunity for adventure is great, while the cost of living is one of the world’s greatest bargains.

The Philippines stands out as perhaps being the most welcoming place for an international retiree, and we aren’t simply talking about the warm hospitality the country is known for. The Philippines offers a Special Resident Retiree’s Visa (SRRV), a special non-immigrant visa for foreign nationals who would like to make the Philippines their second home or investment destination. Before we go further, let’s first discuss the pros and cons of retiring in the Philippines.

Benefits of Special Resident Retiree’s Visa (SRRV)

- Indefinite stay with multiple-entry/exit privileges;

- Access to the Greet & Assist Program at selected Philippine airports;

- Free subscription to the PRA Newsletter;

- Discount privileges from PRA accredited Merchant Partners;

- Free assistance in transacting with other government agencies;

- Entitlement to PHILHEALTH benefits & privileges.

- Exemption from:

- Philippine Bureau of Immigration ACR-I Card (Annual Report)

- Customs duties & taxes for one-time importation of household goods & personal effects

- worth up to US$7,000.00 Tax from pensions & annuities

- Travel Tax, if the retiree has not stayed in the Philippines for more than 1 year from the last date of entry

- Student Visa/Study Permit

Why Retire in the Philippines? Pros & Cons

Life in the Philippines is fairly cheap, but the costs do vary between areas. Imported and luxury goods can be found in the larger cities – which have malls and amenities like any large western city might. However, they can be relatively expensive. Despite this, if you live a little more like a local, get to know your local vendors, and avoid places where you might be charged extra as a ‘tourist’, you can attain a very high quality of life for a relatively low cost.

However, moving to the Philippines is not for everyone. There is a frantic pace of life, which can take its toll on some people. There are also cultural differences that may put some people off.

Communication in the Philippines

Another thing is that is important is communication. Almost every Filipino can understand and speak some English. Two official languages are Filipino and English. English is widely used and is the medium of instruction in higher education. The Philippines forms the third-largest English-speaking nation in terms of population.

Medical Services

Obtaining healthcare may be a challenge in the Philippines depending on where you stay. If you live in the capital, Manila, it’s very easy to get access to healthcare. However, other areas lack sufficient healthcare facilities. This can pose a serious issue for those with chronic conditions or ex-pats who require frequent medical attention.

But if you have easy access to hospitals, healthcare costs significantly lower than it does in the U.S. and you can easily sign up for a local health insurance plan. You can also apply for the government healthcare program PhilHealth. Unfortunately, however, hospitals in the Philippines don’t accept traditional Medicare. Plus, many hospitals require payment at the point of service.

Internet in the Philippines

The country’s average mobile internet download speed of 12.09 Megabits per second (Mbps) is significantly far below the global mobile internet download speed of 30.89 Mbps.

Moreover, the country’s average fixed broadband internet download speed of 21.00 Mbps also falls below the global fixed broadband internet download speed of 39.62 Mbps. These results only show that the country is still far from a reliable and efficient internet connection.

The main reason why this country is still branded with its slow internet speed is that the country severely lacks cell sites. Compared to 70,000 cell sites in Vietnam or over a million cell sites in China, the Philippines has the lowest cell site density in Asia.

Cost of Living in the Philippines

The main appeal for retirement in the Philippines is the lower cost of living. Housing, food, and labor costs are a lot lower than in other nations. There are also good currency exchange rates when sending money to the Philippines, meaning that retiree’s money goes further. The Philippines extends a number of incentives to ex-pat residents, including discounts for retirees over 60 and the duty-free import of household goods.

The data site, Numbeo, provides average cost of living data which can give valuable insight into the prices of everyday essentials, entertainment, and travel in different locations. We compare the Philippines and the U.S. in terms of specific costs.

- Rent Prices: 79.16% lower than in the U.S.

- Consumer prices with rent: 59.19% lower than in the U.S.

- Restaurant meal prices 71.48% lower than in the U.S

- Grocery prices: 50.24% lower than in the U.S.

- Local Purchasing Power: 76.94% lower than in the U.S

Expense | The average price in the Philippines (USD) |

Monthly rent for a small apartment in a good neighborhood | $230 – $300 |

City center apartment rental (Three bedrooms) | $420- $470 |

Monthly utility bill | $40 – $60 |

Internet connection | $30 – $50 |

3-course dinner & wine for two | $25 – $30 |

Monthly groceries bill | $250 |

Private routine medical appointment | $15 |

Men’s haircut | $5 |

Theatre for two | $25 |

A gallon of gas | $4 |

Public transport for a month | $20 |

Pint of beer | $1.50 |

*The total cost to enjoy retirement in the Philippines is between $800 and $1,200 a month (£600-£950 or A$1,200-A$1,800).

This means that price may be a factor in deciding where to retire in the Philippines. The best place to retire in the Philippines depends on your individual circumstances – what sort of house you want to live in, and what you want to be close to. Cities are closer to more amenities, however, houses in cities are more expensive. Conversely, it is cheaper to live outside the city, but you will be further away from amenities.

Another option aside from renting is buying a condominium. This could be cheaper in the long run, especially if you plan on living in the Philippines for a while.

Safety in the Philippines

Despite its scenic beauty, the Philippines can get dangerous in some areas. One of the latest travel advisories issued by the U.S. State Department in 2018 warned Americans to exercise “increased caution due to crime, terrorism, civil unrest, and a measles outbreak.”

The note particularly advised people to avoid travel to Sulu Archipelago, including the southern Sulu Sea, Marawi City in Mindanao, and other areas of Mindanao

In any case, you should review the Crime and Safety Report for the Philippines that the State Department issued.

However, Palawan, Batanes, Cagayan de Oro, Pagudpod, Ilocos Norte, and Davao City are the safest areas in the Philippines.

Philippines Currency

The official currency in the Philippines is the Philippine Peso. You’ll see it written using the currency symbol ₱, and the code PHP in exchange offices and online. One Peso is made up of 100 Centavos. Mostly, banknotes are used in the Philippines, although there are also smaller denomination coins in circulation.

Exchange rates rise and fall. I recommend using an online converter to get the most up-to-date figures. Here are some general, rounded figures to give you a basic understanding:

- 1000 GBP (pounds) = 63,840 PHP (Philippine pesos)

- 1000 USD (U.S. dollars) = 47,480 PHP (Philippine pesos)

- 1000 AUD (Australian dollars) = 37,370 PHP (Philippine pesos)

How to Retire in the Philippines

What is the Visa for Retiree in the Philippines?

The Philippines offers a special retirement visa for anyone who meets certain requirements. The Special Resident Retiree’s Visa (SRRV) is issued by the Bureau of Immigration (BI) of the Republic of the Philippines under the Retirement Program of the Philippine Retirement Authority (PRA) to foreigners and overseas Filipinos. It entitles the holder to multiple-entry privileges with the right to stay permanently/indefinitely in the Philippines.

ALSO READ: Dual Citizenship in the Philippines: Helpful Tips and Guides

Who may apply for Special Retiree’s Resident Visa (SRRV)?

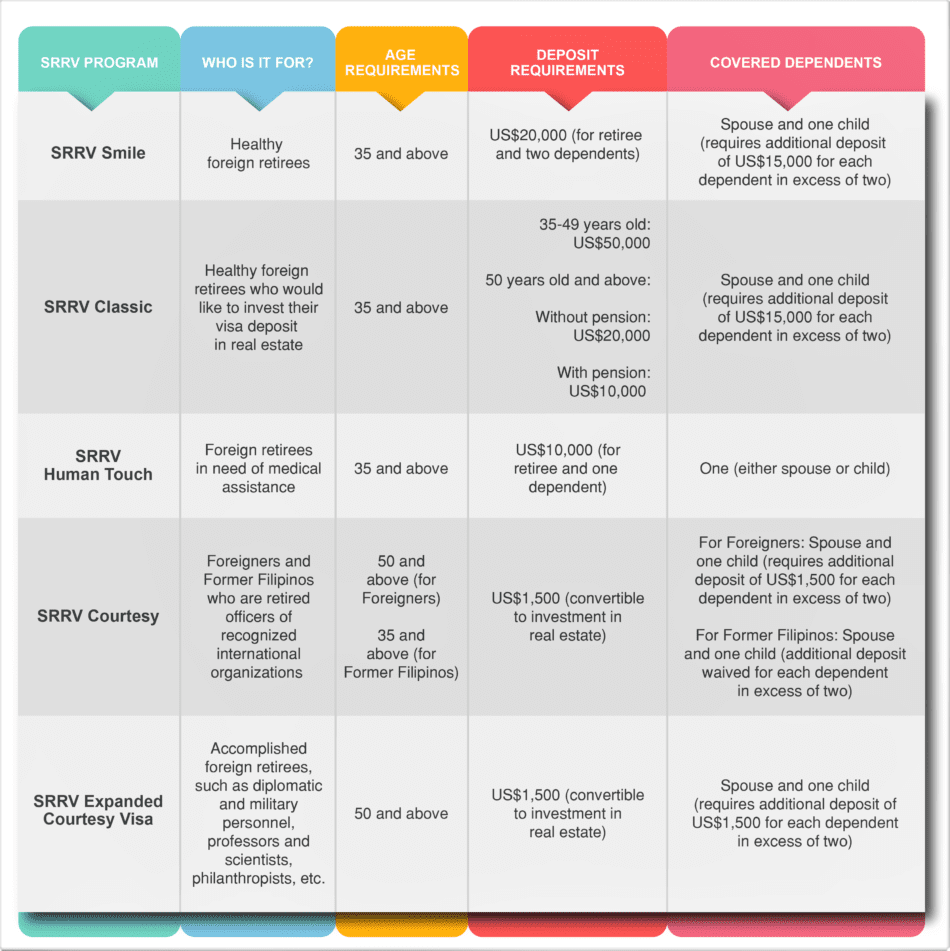

A retiree who applies for a Special Resident Retiree Visa (SRRV) has the option to enroll to the program based on his retirement status.

Retirement Option and their Required Time Deposit

1. With Pension – 50 years old and above – the required time deposit is US$10,000.00 plus a monthly pension of US$800.00 for a single applicant and US$1,000 for the couple.

2. Without Pension

- 35 to 49 years old – US$50,000.00 time deposit

- 50 years old and above – US$20,000.00 time deposit

- Former Filipino Citizens (at least 35 years old, regardless of the number of dependents – US$1,500.00)

- Ambassadors of Foreign Countries who served and retired in the Philippines, current and former staff members of international organizations including ADB (at least 50 years old) – US$1,500.00

3. A resident retiree can bring with him, without additional deposit, his spouse and child who is unmarried and below 21 years old or if the spouse is not joining, two(2) children (provided they are unmarried and under 21 years of age.) Additional children with the same qualifications may also be allowed to join the principal retiree provided there is an additional deposit of US$15,000.00 per child. The said time deposit, however, is subject to the same and conditions as that of the principal deposit. This does not apply to former Filipino Citizens.

ALSO READ: 21 Philippines Tourist Spots that Look Like Foreign Destinations

What is the validity of SRRV?

The holder of the SRRV may reside in the Philippines without securing extensions of his stay from the Bureau of Immigration.

Are SRRV holders exempted from Travel Tax?

PRA members who are holders of valid SRRV are exempted from paying travel tax provided they have not stayed in the Philippines for more than one year from the date of last entry into the country.

Can SRRV holders own real property in the Philippines?

No. If he or she is legally married to a Philippine citizen, he or she may construct a residential unit on a parcel of land owned and/or registered in the name of a Philippine spouse. Natural-born former Filipinos whose SRRV has been issued may own/acquire a maximum area of 5,000 square meters of urban land and three (3) hectares of agricultural land.

Is the dollar deposit convertible to other currency?

The dollar deposit may be converted into a peso after 30 days upon issuance of the Special Resident Retiree’s Visa (SRRV).

Where do I get the approval of the SRRV?

The approval of your application will come from the Bureau of Immigration. The pre-evaluation of the application is made by the Philippine Retirement Authority where applications are filed.

How to Retire in the Philippines

How long is the processing time?

Processing time takes seven to ten working days upon receipt of complete requirements.

Can my spouse and unmarried minor children be granted an indefinite privilege to reside in the Philippines?

Yes. Your spouse and a legitimate or legally adopted unmarried child under twenty-one (21) may be given an indefinite status if they are accompanying or joining you soon after your admission into the country as such.

Is there an additional deposit for unmarried children if they are following or accompanying me?

Yes. There is an additional deposit of US$15,000.00 or any equivalent acceptable foreign currency for each How long is the processing time?

Processing time takes seven to ten working days upon receipt of complete requirements.

Can my spouse and unmarried minor children be granted an indefinite privilege to reside in the Philippines?

Yes. Your spouse and a legitimate or legally adopted unmarried child under twenty-one (21) may be given an indefinite status if they are accompanying or joining you soon after your admission into the country as such.

Is there an additional deposit for unmarried children if they are following or accompanying me?

Yes. There is an additional deposit of US$15,000.00 or any equivalent acceptable foreign currency for each additional legitimate or legally adopted unmarried child under twenty-one (21) years of age.

What are the benefits of SSRV?

- Permanent non-immigrant status with multiple-entry privileges through the Special Resident Retiree’s Visa;

- Exemption from customs duties and taxes for the importation of personal effects;

- Exemption from Exit Clearance and Re-entry Permits;

- Exemption from payment of travel tax provided the retiree has not stayed in the

- The Philippines for more than one year from the date of his last entry into the country;

- Conversion of the requisite deposit into active investments, including the purchase of condominium unit;

- Interest on the foreign currency deposit is tax-free and payable to a retiree in Philippine Pesos;

- Foreign currency time deposit can be converted into Philippine Pesos deposit, but interest is subject to withholding tax;

- Pension, annuities remitted to the Philippines are tax-free; and

- Guaranteed repatriation of the requisites deposit including invested profits, capital gains, and dividends accrued from investments, upon compliance with Bangko Sentral rules and regulations.

ALSO READ: How to Convert a Foreign Driver’s License in the Philippines

Requirements for SRRV

- Completed Philippine Retirement Authority application form;

- Valid passport;

- DFA Medical Examination Form No. 11 accomplished by a licensed physician from the applicant’s place of origin, including AIDS Test, duly authenticated by the Philippine Embassy/Consulate posted there or PRA Medical Certificate (RSSC Form No. 002) accomplished by a licensed physician in the Philippines;

- Certification by PRA shortlisted bank of the requisite deposit in the following categories;

A. With Pension – 50 years old and above – the required time deposit is US$10,000.00 plus a monthly pension of US$800.00 for a single applicant and US$1,000 for couple.

B. Without Pension

- 35 to 49 years old – US$50,000.00 time deposit

- 50 years old and above – US$20,000.00 time deposit

- Former Filipino Citizens (at least 35 years old, regardless of the number of dependents – US$1,500.00)

- Ambassadors of Foreign Countries who served and retired in the Philippines, current and former staff members of international organizations including ADB (at least 50 years old) – US$1,500.00

- Police Clearance, duly authenticated by the Philippine Embassy/Consulate, issued abroad or National Bureau of Investigation (NBI) Clearance, issued in the Philippines;

- Photographs, 2.4 cms, and 5 cms. six (6) pieces each;

- If the spouse is joining the applicant, Marriage Certificate or Marriage Contract if the applicant’s marriage was solemnized in the Philippines or Marriage Certificate duly authenticated by the Philippine Embassy/Consulate nearest the applicant’s residence abroad if the marriage was contracted abroad (under PRA rules, should the resident retiree suffer an untimely demise, the surviving spouse who is a holder of SRRV has the option to become the principal retiree using the original principal dollar deposit as his/her qualifying deposit. If he/she chooses not to, the law on succession shall apply);

- If dependent/s is/are joining the applicant, Birth Certificate/s of dependent/s born in the Philippines or Birth Certificate/s or Household Register duly authenticated by the Philippine/Consulate nearest the applicant’s residence abroad; and

- Payment around US$450

ATTACHMENT: SPECIAL RESIDENT RETIREE’S VISA APPLICATION FORM.PDF

There are quite a few reasons you should consider retiring in the Philippines. Firstly, the familiar language and culture of the country offer some ex-pats a certain comfort level not found elsewhere in Southeast Asia.

Additionally, many people are surprised by the low cost of living in the country. Most ex-pats can live comfortably on US$1,000 per month in the Philippines. The total includes items such as dining out and domestic travel.

Understand When Safety Can Be a Concern

Like everywhere in the world, the Philippines has its downsides. In some areas of the Philippines, the infrastructure isn’t dependable, and power outages are a part of everyday life. Political volatility and civil unrest have made safety concerns in some spots, including the Sulu Archipelago and Marawi City. Being aware of these challenges and the fact that a big percentage of the Philippines’ population lives in poverty is the first step to avoiding problems. Retirement communities are often far removed from the dangerous areas. The government is committed to the tourism industry, and keeping popular areas safe is a priority.

ALSO READ: 14 Remote Luxury Resorts in the Philippines

Apply Visa Online

- New SRRV Application: clientrelations.pra@gmail.com / clientrelations@pra.gov.ph

- Pre-Evaluation of SRRV Application: srrv.preevaluation@pra.gov.ph

- Status of SRRV Application: processing@pra.gov.ph

- PRA ID Card Renewal: id_renewal@pra.gov.ph

- Request for Entry Exemption Document: reentryrequest@pra.gov.ph

- Inquiries/Request for Travel Pass: entryexit@pra.gov.ph

- Cancellation of SRRV: cancellation.pra@gmail.com

- Special Concerns: servicing@pra.gov.ph

PHONE & FAX

Office Hour : 7:00am – 4:00pm

Open: Monday, Tuesday, Thursday and Friday (Skeletal Workforce)

Closed: Wednesday (Disinfection), Saturday and Sunday

Phone: (02) 8848 1412 to 16

Fax: (02) 8848 1421

Due to the present pandemic, please closely monitor your email for any announcement

ADDRESS

| Head Office 29th Floor, Citibank Tower, 8741 Paseo De Roxas, Makati, Metro Manila | Baguio Satellite Office Unit 8, Bldg.3 Nevada Square, No.2 Loakan Road, Baguio City, Benguet | Clark-Subic Satellite Office Savers Mall, 3rd Floor, Best Western Metro Clark MacArthur Highway, Angeles City | Cebu Satellite Office Unit 202 Club Ultima Tower II, Crown Regency Hotel & Towers, Jones Ave, Cebu City | Davao Satellite Office Suite A306 Plaza de Luisa Building, Ramon Magsaysay Avenue, Davao City |

Foreign Property Ownership Is Restricted

Buying a home in the Philippines is more complicated than it can be in other parts of the world due to restrictions on property ownership. Foreigners are permitted to purchase condominiums and townhouses only. Land ownership is limited to Filipino citizens.

Rental options range from budget to luxury, but even luxury rentals are a bargain. You’ll find rental services in every city with an ex-pat community. However, the best ways to find a property to rent are word of mouth, walking around the neighborhoods where you’re interested in settling, and looking for “for rent” signs. You’re more likely to be able to negotiate the terms of the lease by dealing directly with the owner than by working through an agency.

NOTE: This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication.

SOURCE: Philippines Embassy & PRA

Tagaytay Highlands Luxury Living

Manila Accommodation

Travelers to Manila give high marks for the shopping, cathedral, and top-notch restaurants. Tourists who journey to this culturally-rich city can discover its Chinatown, live music, and entertainment choices. Top sights in the city include SM Mall of Asia, San Agustin Church, and Rizal Park.

- There are 803 hotels and other accommodations in Manila

- The closest major airport is in Manila (MNL-Ninoy Aquino Intl.) 10.4 from the city center

Amazing blog! Do you have any hints for aspiring writers? I’m planning to start my own website soon but I’m a little lost on everything. Would you recommend starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally overwhelmed .. Any tips? Cheers!

Thank you for the kind words about my blog! For aspiring writers, I’d suggest starting with a free platform like WordPress.com to get the hang of things. Once you’re comfortable, you can consider moving to a paid option for more features. Consistency and quality are key, so focus on regular, high-quality content. Learn some SEO basics to help your blog get discovered. Good luck with your website! Cheers!

Wow, amazing blog format! How lengthy have you ever been blogging

for? you make blogging glance easy. The whole look of your

site is magnificent, as well as the content material!

You can see similar here najlepszy sklep

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/zh-CN/join?ref=B4EPR6J0

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/join?ref=S5H7X3LP

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/join?ref=B4EPR6J0

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/pt-BR/join?ref=53551167